Customer Credit

Credit is an arrangement by which a buyer can take possession of something now and pay for it later or over time.

Reasons for giving Credit

- To gain competitive edge.

- To earn additional money.

- To sell a very expensive items.

- When the product sales is on decline.

Matters discussed in agreement

- Details about the buyer and seller.

- Details of the asset to be bought/sold.

- Amount of finance.

- Repayment period.

- Monthly installment.

- Interest rate charged.

- Collateral security involved.

- Rights and responsibilities of both parties.

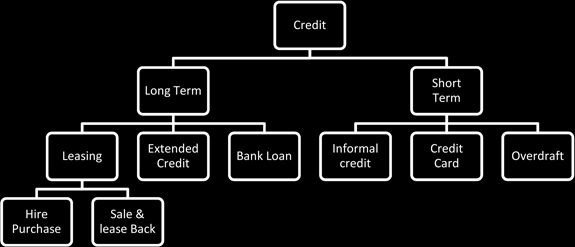

Short Term Credit

- The amount of credit is low.

- Credit is to be paid within one year.

Informal Credit

- Credit is given without any written agreement.

- Does not involve collateral security.

- Small amounts are involved.

- Repayment is to be made within one year.

- Normally offered by the retailer to their trustworthy customer.

Credit Cards

|

|

- Advantages:

- Advantages to Card Holder:

- Increases purchasing power.

- Minimum cash handling.

- Obtain cash at ATM.

- Can be canceled when stolen.

- Postponement of payment.

- Advantages to Bank:

- Interest from card holder.

- Commission from retailer.

- Advantages to Retailers:

- More sales.

- Competitive edge.

- Minimum cash handling.

- Advantages to Card Holder:

- Disadvantages:

- Disadvantages to Card Holders:

- Limited acceptability.

- Interest is charged.

- Irrational buying.

- Every one can not have this facility.

- Can be misused.

- Disadvantage to Bank:

- Recovery of money from defaulters.

- Disadvantages to Retailer:

- Commission and rental to be paid to the bank.

- Problem of limited cash.

- Disadvantages to Card Holders:

Over Draft

- A short term facility offered by the bank to the its customers where the borrower

can over draft (withdraw money more than their balance) their accounts maintained with the banks. - Available only for current accounts.

- Used by businesses to manage cash flow problems.

Long Term Credit

- Amount of Credit is large.

- Repayment goes beyond one year.

- Repayment is made in installments.

- A written agreement is singed.

- Collateral security are involved.

Leasing

- A rental agreement which involves a series of fixed payment (annuity) which is extended to several period.

- Lessor: One who owns the asset and lets other (lessee) use it.

- Lessee: One who gets procession of the asset for its use.

Hire Purchase

- A leasing agreement in which the lessor lets the lessee use an asset for a certain time period (less that the life of the asset) upon a certain installment (rental) with an option to purchase the asset by paying the amount or return the good to lessor,

after the lease period. - Suitable for asset with good resale value.

- The lessor will own the asset till the last installment has been paid and the total value of the asset is recovered.

Sale and Lease back

- Lessee originally owns the asset.

- The asset is sold to the lessor on the bases of market price and lessee gets the full amount in lump sum.

- Title will be in the name of lessor.

- Possession will remain with lessee.

- Lessee is liable to pay installments to the lessor as per agreement.

- Lessee can not sell the asset till the installment are paid and asset comes under his ownership.

- If lessee faults in making payments lessor has the right the repossess the asset.

Extended Credit/Deferred payment

- It is suitable for items with low resale value.

- In this case customer will become owner after signing the agreement and making payment of front and fee.

- Customer can sell the asset any time.

- Loans are secured by a collateral security.

- If customer defaults making payment the financer has the right to sue him.

Comparison between Bank Loan and Leasing

| Bank Loan | Leasing | |

|---|---|---|

| 1. | Cheaper source of finance | Expensive source of finance |

| 2. | Collateral security is involved | Collateral security is not involved |

| 3. | Good is actually sold | Good remains in the owner ship of the seller |

| 4. | In case of payment defaults bank can not repossess the good | I case of payment defaults seller can repossess the good |

| 5. | Suitable for goods with no second hand value | Suitable for goods with good second hand value |

Advantages and Disadvantages of Customer Credit

| Advantages | Disadvantages |

|---|---|

| To the Economy | |

| 1. Encourages the sale of expensive goods. | 1. Can cause general increase in price level. |

| To the Seller | |

| 1. Increases turnover and thus profit. | 1. If seller finances the installment-buying then capital requirement is increased. |

| 2. Enables stocks to be cleared. So less risk of stock going out-of-date. | 2. If buyer defaults in making payment then seller has to re possess the goods which may be damaged. |

| 3. Can earn interest if he is also financing. | 3. Administrative expense to record installments. |

| To the Buyer | |

| 1. Raises the standard of living. | Has to pay extra interest. |

| 2. It is a way of forced saving. | 2. Encourages people to spend rashly. |