Banking

A banker or bank is a financial institution whose primary activity is to act as a payment agent for customers and to borrow and lend money.

Importance of Bank

- Safekeeping for cash.

- Safe and convenient means of making payment.

- Provides finances.

- Provides interest.

Types of Banks

Central Bank

- One central bank in each country.

- Issues, controls and regulate the supply of money in the country.

- Designing and enforcement of monetary system (a policy related to interest rates and money supply to control economy).

- Acts as lender of last resort to commercial bank.

- Makes policies for controlling activities of commercial banks.

- Manages public debt (money borrowed by the government).

- Manages foreign exchange reserves.

- Financial advisor of the government.

Commercial Bank

- Private owned and profit seeking.

- Basic units of banking system.

Services of Commercial Bank

- Accepting deposits.

- Lending Money.

- Means of Payment.

- Other services.

1. Accepting Deposits

Banks Accepts deposits from customers into the following account.

- Current Account

- Savings Account

- Fixed Deposit Account

| Savings Account | Fixed Deposit Account | Current Account | |

|---|---|---|---|

| 1. | Suitable for those who wishes to save small sums of money. | Suitable for those who have extra money to be set aside to earn interest. | Useful for businesses who needs safe method to make and receive payments. |

| 2. | Opened with minimum deposit. | Opened with large deposit. | Opened with large deposit. |

| 3. | Earns low interest. | Earns high interest. | Earns no interest. |

| 4. | No need to pay bank charges. | No need to pay bank charges. | Has to pay charges if deposit falls below certain amount. |

| 5. | Money can be deposited and withdrawn any time. | Amount of deposit remains fixed. Can not be withdrawn. | Money can be deposited and withdrawn any time. |

| 6. | Certain limit of withdrawing money. | Money can not be withdrawn until a specific period expires. | No Limit of withdrawing money. |

| 7. | - - - - - - - - - - - | Certificate of deposit. | - - - - - - - - - - - |

2. Lending Money

Any customer with a bill of future maturity date can be negotiated with the bank to get money against the bill on prevailing discount rate on their face value.

2.2. Bank Loan

- Is a lending facility offered by the bank to meet long term financial requirements of borrower.

- Normally a loan is granted for acquiring any fixed asset or for development of infra structure.

- If sanctioned, loan amount is paid to the borrower through a cross cheque/cashier or manager’s cheque which can be deposited on any bank in which borrower maintains an accounts.

- Borrower has to pay the principal amount along with the interest.

- A bank considers the following before granting the loan.

- Purpose of loan.

- Credit worthiness of the borrower (CIB).

- Amount of loan.

- Duration of loan.

- Collateral security.

2.3. Bank Over Draft

- A short term facility offered by the bank to the borrowers where the borrower can over draft (withdraw money more than their balance) their accounts maintained with the banks.

- Normally available for the businesses.

- Also known as running finance facility.

- It is offered to manage cash flow problem.

- Only available for current account.

| Bank Over Draft | Bank Loan | |

|---|---|---|

| 1. | Customer must have a current account. | No need. |

| 2. | Offered for short term period. | Offered for long term period. |

| 3. | Provided to help cash flow problem. | Provided to help borrower acquire or develop infra structure. |

| 4. | Interest is charged on availed amount. | Interest is charged on principal amount outstanding. |

| 5. | Interest rate is higher. | Interest rate is lower. |

| 6. | Bank statement will show debit balance. | After loan amount is deposited in to the bank, Bank Statement will show credit balance. |

| 7. | Bank will create charge against current assets. | Bank will create charge against fixed assets. |

| 8. | Money paid into the borrower’s account reduces its debt. | Loan is repaid by standing orders. |

3. Means of Payments

- Payer: One who is making payment.

- Payee: One who is getting payment.

- Drawer: The one who signs the cheque.

- Drawee: The bank upon which the cheque is drawn.

- Open cheque is cheque which is cashable over the counter of the particular bank on which it is drawn.

- Bearer cheque: A cheque which is payable to the holder.

- Order cheque: A cheque which is payable to specific person. If the first payee want to give the cheque to another person he must endorse the cheque to him with his sign.

- Crossed cheque is a cheque which can not be cashed over a counter but must be paid into a account.

Advantages of Cheques

- Minimum cash handling.

- Convenient and Safe.

- Track record of payment can be maintained.

- Better business control.

- Some times it is a legal obligation.

Disadvantages of Cheques

- Cheques can be dishonored.

- Payments through cheques means limited hard cash.

- Paper work increases.

- Not suitable for petty purchases.

How Cheques are dishonored

- Balance not available in payers (drawers) account.

- There is some discrepancy in amount written in words and in figures.

- There is some cutting/over writing on the cheque.

- Tempered cheque.

- Cheques issued form frozen account.

- Signatures do not tally.

- Stale cheque (older than six months).

- Post dated cheque.

- Cheque issued from a person reported dead.

- Payment is stopped by payer.

- Cheque issued by insane person.

How to overcome the problem of dishonored Cheques

- Check cheques before accepting them.

- Keep careful records of customers who have caused problems.

- Ask for cash payment.

- Take the person to court.

- Insist on the use of a cheque guarantee card (see below).

- Do not accept cheques beyond the limit of the card (see below).

Cheque cards are issued by bank to their credit worthy customers, guaranteeing to the payee that a cheque drawn by the card holder will be honored by the bank even if there are insufficient funds in the account of drawer.

3.2. Bank Draft

- Issued by the bank in favour of payee on the advice of the payer.

- The payer approaches the bank with the request and payment in cash or through cross cheques in favour of the bank.

- Payer has to pay bank charges in addition to the amount of payment.

- At is a secured means of payment.

- Usually suitable when buyer and seller are not known to each other, and seller wants secure means of payment (of course bank is more reputable than a person).

3.3. Standing Order

- Suitable especially for annuity payment for example hire purchase.

- These are orders to a bank to pay regularly a fixed sum of money from one’s current account to a specific payee.

- Payer gives bank written instructions.

- Advantages:

- Payments are made automatically. Increases credit worthiness.

- Payer need not to remember the due dates of payment.

- Disadvantages:

- Some times there is not enough balance and the cheque is dishonored.

- Only suitable for fixed amounts and regular intervals.

3.4. Direct Debit

- Same as Standing Order except that payments of varying amounts at irregular intervals can be made.

- In this case the debtor not the creditor asks for payment.

3.5. Credit Transfer

- Suitable for making payments to a number of payees at the same time.

- Used to pay salaries, rents, hire purchases installments.

- Payer gives information of payees in written to the bank.

- Payer writes a cheque in the favour of the bank of the whole amount to be paid.

Advantages:

- Time saving.

- Saving on admin costs.

- Track record of the payments.

- Saves on cheques and postages.

Disadvantages:

- Possible only when payee has bank account.

- There are bank charges.

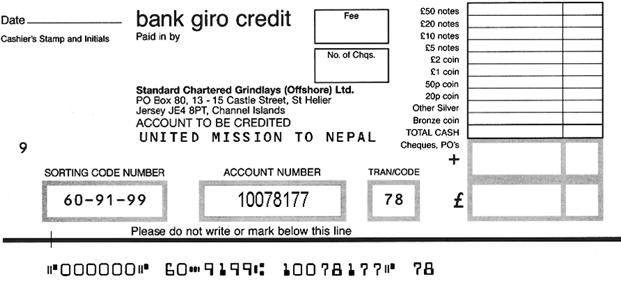

3.6. Bank Giro

- It allows payment to be made at any branch of any bank to any branch of any bank in the country.

- It is available to those who do not have a bank account as well as to those who do.

- A payer can deposit money by cash or through cross-cheque into a payee account by filling a “bank giro credit slip”.

- It is used to pay wages and salaries.

3.7. Online Payment

- Payment can be deposited into payee’s account through internet.

- Used for both local and especially more common in international transactions.

- Payer has to go to any branch of the bank where payee holds his account.

- Payer has to fill in ‘online deposit slip’ by mentioning payees account number and branch name and code.

- Bank where payer deposits the money will remit it to payees bank branch.

- Remittance will be made in a few minutes.

- Remittance is sending of money without physical movement of money.

4. Other Services

- Banks acts as agent of the payee for accepting payments.

4.2. Foreign Exchange

- In additional to central bank, commercial banks also buy and sell foreign exchange.

4.3. Issuance of Bank Statement

- It is issued by the bank to their account holder on periodic basis or on demand.

- Acts as a summary of all the transactions that account holder makes.

- Generally mentioned in running balance format.

4.4. Credit Cards

Discussed in detail in chapter 6-Consumer Finance.

4.5 Debit Cards

- A plastic card with a magnetic tape or with a micro chip on it, issued by commercial banks to their account holders.

- These can be used for making payment at selected retailers or for drawing cash from ATMs.

| Debit Card | Credit Card | |

|---|---|---|

| 1. | Issued to account holder. | Issued to any credit worthy customer on request. |

| 2. | There is no limit upto which card can be used. | There is limit upto which card can be used. |

| 3. | When ever card is used, money is transferred from holders account to retailers account. | When ever card is used, money is paid by the bank. |

| 4. | No bill is made. | Bill is made and sent periodically to the card holder. |

| 5. | No interest. | Interest is charged. |

| 6. | Holder has to pay bank charges. | No transaction based charges. |

4.6. ATM and ATM Cards

- ATM (Automated Teller Machines) is a computerized telecommunications device that provides customers a method of financial transactions in a public space without the need for a human clerk or bank teller. Most banks now have more ATMs than branches, and ATMs are providing a wider range of services to a wider range of users.

- ATM card is a plastic card which is issued by the bank to its account holders on their request.

- This card is used to draw money by using it at ATMs.

- Services provided by ATMs:

- Mini Bank Statement.

- Utility Bills payment.

- Balance enquiry.

- Balance Transfer (BTF).

- Deposit Money.

- All debit cards are ATM cards but all ATM cards are not debit cards.

4.7. Telebanking

- A special facility which is offered by the banks to their account holders on their request.

- It is a service which allows its customers to perform transactions over the telephone.

This normally includes bill payments for bills from major billers (e.g. for electricity)PIN is used to access the bank account. - Facilities:

- Pay bills.

- Checking Bank balance.

- Balance Transfer Facility (BTF).

- Requesting cheque books.

4.8. Internet Banking

- It is a term used for performing transactions, payments etc. over the Internet through a bank.

- Customer has to open the banks website.

- PIN code is used for authentication.

- Facilities are same as Telebanking.

4.9. Lockers

- A facility offered by the banks to their customers on their request to deposit their valuables in Bank Lockers.

- Each locker has two keys one given to customer and one rests with the bank.

- Valuables kept may be under a insurance cover provided by the bank upto certain limit.

4.10. Night Safe Deposits.

- A facility offered by the bank to account holders to deposit money after bank timings.

- Used to add money into one’s own account.