| Home | Revision | A-Level | Economics | Theory of Production & Costs | Perfect competition |

Perfect competition

Perfect competition is defined as a situation where there:

Are many small buyers and sellers (firms) each too small to affect the price – the firms are "price-takers".

Is a homogeneous product [all are identical].

Is free entry and exit. This means that firm can join or leave the industry – it is both

allowed and costs nothing.

Is perfect knowledge.

If we take out “perfect knowledge” (which never exists in the real world) and leave the first three assumptions, we get "pure competition”. It is less than perfect, but is still very competitive.

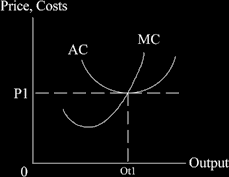

The diagram of an individual firm:

Equilibrium is where the marginal cost curve, MC, cuts the price line, P1. In perfect competition any of the tiny firms can sell more without having to lower its price – it is too small to affect price! This means that the price line above is the marginal revenue also. The firm always gets the same price at the margin.

The price line is also the average revenue in perfect competition. It’s just the maths.

Total revenue = P x Q

Average revenue = TR ÷ Q

Clearly if we multiply P by Q then divide the result by Q we must end up with P again!

Perfect competitors are price takers!

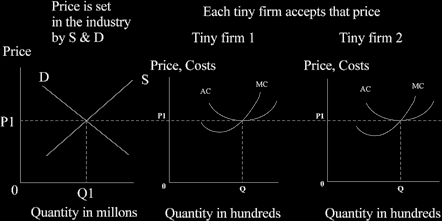

The price is set at the industry level by the total supply and demand curves, in the normal way. Each firm must accept it – because the industry is made up of lots and lots of small identical firms; none can affect price.

The price is set in the industry by the demand of the consumers cutting the industrial supply curve. Where does this supply curve come from? We get it by adding up all the MC curves of each little individual firm in the industry. All these MC curves added up are the industry supply curve as long as we are in perfect competition!

How price is set at the industry level:

And the small individual firms are price takers because they are too tiny to be able to change it - and there is no point selling it for less than they could get.

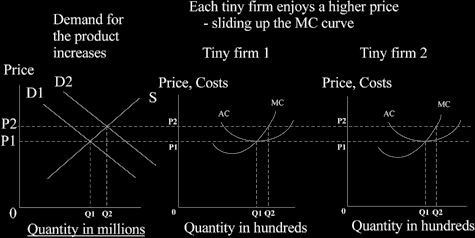

If demand for the product increases in the industry, it causes an increase in price and firms move up the MC curve.

Q. Why the MC curve?

A. As was said above, because the firm is interested in increasing output as long as it brings in a greater revenue than it costs to make the extra bit.

How an increase in demand in the industry affects the perfectly competitive firms:

We first change the price in the whole industry as demand has increased then trace

this over to see what it would be like for an individual firm. The increased demand in the industry causes price to increase; each small firm enjoys this sudden increase in price - and of course its profit increases. The firm then increases output in order to benefit from as a high a profit as it can manage.

Above the equilibrium point where MC cuts the price line P1 (which is also marginal revenue and average revenue as explained earlier), the firm makes more than its normal profit. You can see that at P2 it is operating above the average cost curve. Normal profit is built into the average cost curve – without it the firm goes bust! Above the AC curve, the firm makes “excess profits” or “above normal profits”. However, firms can earn above normal profit like this in the short term only.

Why is this? The above normal profit immediately attracts other firms to enter the industry. After all, they have perfect knowledge which means they know about it!

And the free entry and exit proviso means they can race in! And this means extra output, i.e., an increase in supply at the industry level, so price starts to fall back.

This process bids away the profits all the way down to where we started where MC = MR = AC = P1. So in the long term, under perfect competition, no above normal profits are possible.

Q. Can you take the diagram above, draw it for yourself, then increase the supply curve until P2 falls back to P1? Try it now!

What happens if price falls below AC? At this level, all the firms lose money and continue to do so until some firms go out of business. When they do, supply decreases, so that price starts to increase, and this continues until the price is back to the original equilibrium position.

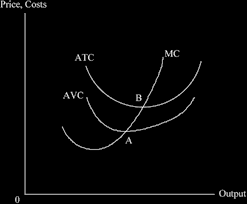

Average variable costs versus average total costs

Average variable costs must always be covered (they go directly into the particular item one is selling); but average total costs are different. Average total costs include all kinds of things, like new toner for the computer’s printer – these do not go directly into any particular item, they just have to be covered in the long run. So a firm can continue in business in the short run, as long as average variable costs are covered, even if average total costs are not. Anywhere between A and B in the diagram below, the firms are covering the variable cost of production and earning a little extra

towards covering the long term total average costs. So it is worth staying in business for some time and hope that market conditions improve (prices rise) so that they will return to profitability. [This is a common multiple choice question].

The advantages of perfect competition

Resources are allocated in the most efficient way to meet market demand and maximise consumer satisfaction.

- This means that market mechanism works better.

It is the cheapest way of using the factors of production we have.

- Which says that we are at the lowest part of the AC curve.

There is no cost of advertising, selling, marketing, or motions. These are often a form of waste to society as a whole, though beneficial for individual firms.

Rapid change is possible to meet new consumer demands – it is very flexible. The interests of producers are the same as for consumers.

Freedom to choose exists.

It avoids all the wastes of monopoly.

It prevents the emergence of a few rich and powerful people (Conrad Black? Robert Maxwell?) There are a lot of firms, all small, so that no major powerful personality can rise and dominate others.

The disadvantage of perfect (or pure) competition

It produces what is demanded under the given distribution of income. We can imagine a scenario with a very few rich people with pet dogs or cats which dine extremely well on chicken and the like, while the masses starve.

Spillovers and externalities can exist. These are costs caused to others, e.g. the disposal of nuclear waste or toxic chemicals by dumping them in streams.

No economies of scale possible - all the firms are too small.

Perfect competition is consistent with a limited choice of range of goods; monopolistic competition may have a much wider range. An example is motorcars – there are an awful lot of different models and competition is much less than perfect.

Little or no research and development is possible because there are no funds for it. Under perfect competition there are no surplus profits (in the long run they are whittled away!) R&D is possible under monopoly because of the surplus profits available.