| Home | Revision | A-Level | Economics | Theory of Production & Costs | An introduction to price.. |

An introduction to price discrimination

Definition: price discrimination is the charging of different prices to consumers for the same good or service in order to increase profits.

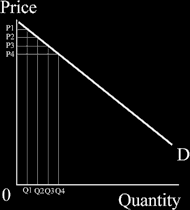

1. First degree price discrimination:

This means that a firm can charge each consumer the maximum s/he would be willing to pay. If perfect price discrimination occurs, it means that the entire consumer surplus is extracted by the producer, and so it falls to zero.

If we think of the demand curve and price starting to fall price in blocks of one unit – Q1 and P1, the producer can extract the area above equilibrium, which, say, is at P3.

Many companies that supply homes with electricity use this method– the first block of units is expensive, then the units get cheaper as the family uses more electricity over the month. Check your electricity bill at home and see if it is happening to you!

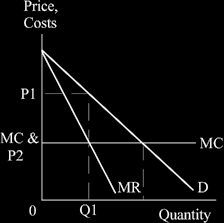

2. Second degree price discrimination:

This occurs when a firm sells at its profit maximising position, and finds it has some goods/services left over, so it sells this surplus more cheaply to others.

This is commonly done with airline seats and hotel rooms – have you heard of lastminute.com? Look it up on the internet – there are bargains to be had! You might also encounter cheaper cinema seats on one day of the week, or perhaps in the afternoon but not the evening.

Where second degree price discrimination exists, fixed costs typically are large, and marginal costs are low or perhaps virtually constant.

Here the firm first produces where MC = MR (at Q1 and sells at P1). Marginal costs are constant – think of empty airline seats where the marginal cost is tiny; it is the cost of one more meal and a miniscule extra amount of fuel.

The company can increase its profits further by selling the first quantity at the high price OP1, then expanding its output to Q2 and selling the remainder for price OP2. The computer programs the airlines use are sophisticated, and can offer seats at different prices, starting a bit below P1 and reducing all the way to P2, to earn more money. On any full commercial airline, the passengers are normally paying a whole variety of prices for this reason.

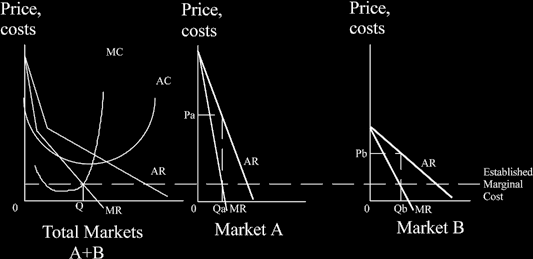

3. Third degree price discrimination:

This is often called “the price discriminating monopolist”.

This happens where a monopolist can sell at different prices in different markets. To occur at all, it requires three things:

There is a monopolist.

The markets can be kept separate.

There are different elasticities of demand in each market.

The consumers in the market with the most inelastic demand always face a higher price.

We locate the marginal cost in the usual way, from the monopoly diagram. We then apply that MC to both the separate markets. Because each separate market has a different demand curve and elasticity, they have different marginal revenue curves. Putting this another way, once we know the actual MC figure, we can trace it across

to both markets, see the intersection with the MR curve in each, and set the price in each. This will be different in each market because the elasticities are different.

We determine the overall MC=MR position on the left hand side of the diagram below. Then once we have the MC point established, we read this MC across to where it cuts the individual MR curves in the first two diagrams. That point determines the price in each market, reading up off the demand curve in those separate markets.

The market with the relatively inelastic demand always has the higher price. This is expected as the greater the inelasticity, the more people want to buy it and are prepared to pay that much more for it.

This situation of different elasticities is typical of foreign markets and home markets. In the world in which we live, for most goods and services the demand in the global market is more elastic than in each domestic market. This is because competition is greater at the global level - the whole world competes! Therefore, firms that export often charge more in the home market (where the elasticity of demand is lower) than abroad.

Any multiple choice question or data response question about different prices in different markets will be about the first, second or third degree discrimination possibilities. You just have to think about it and decide which one it is, unless the question makes it clear upfront.