| Home | Revision | A-Level | Economics | Why Markets Can Fail | Reason 5 - Demerit goods |

Reason 5 - Demerit goods

Demerit goods

Demerit goods are exactly the opposite of merit goods in that they are over-consumed by individual people and this causes problems for the nation as a whole.

Cigarettes are a clear example: they cause unpleasant smoke which is dangerous to people in the area who are forced to become passive smokers. They also cause cancer and a whole range of nasty diseases, including emphysema. They inflate the national health bill because both the smokers and the passive smokers get sick and visit the doctor. But smokers will not stop, perhaps are unable to stop, because they are addicted.

Too many demerit goods are demanded, so the government steps in and taxes cigarettes highly in order to reduce consumption and to raise revenue which is needed anyway to spend on treating smokers. The government also advertises heavily to try to persuade people to stop smoking and the young not to start and is seriously considering banning smoking in all public work places, as Ireland did in 2004. Some individual doctors are also refusing to treat smokers for smoke-related diseases unless they stop smoking which adds to the pressure.

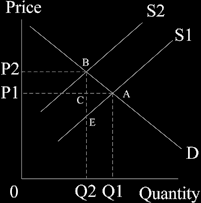

The effect of the government taxation is in the diagram below. The indirect tax EB is added vertically to the supply curve, which shifts upward and to the left from S1 to S2.

This reduces the consumption from OQ1 down to OQ2, (a move from the equilibrium point A to B) as price rises from P1 to P2 and consumers contract up the unchanged demand curve.

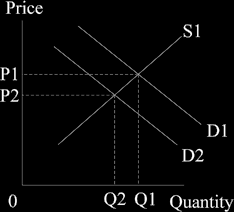

Rather than simply relying on tax to decrease the supply curve and force up the price, the government may also try to tackle the demand side. It can do this in the ways mentioned above and the diagram is reproduced below.

You will observe that, if successful, the quantity smoked falls.

The government uses both methods, reducing demand and taxing heavily, to deal with smoking as a demerit activity!