| Home | Revision | A-Level | Economics | Managing the Economy | The multiplier and interest rate |

The multiplier

If we change aggregate demand by a given amount, the level of GDP alters bymore; the multiplier measures this relationship. For example, if we increase consumption by £100 million and find that gross domestic product increases by £320 million, the multiplier is

3.2 (320 divided by 100).

Why does this happen?

It is not difficult to understand. Assume I buy something from you for £100 – you will spend some of it, perhaps ninety per cent, or £90. Whatever you buy from someone else, they get the £90, and spend some of it – this time £81 (90%). Already you can see that total spending has been £100 + £90 + £81 or £271 in all. And the chain is not yet ended! Eventually, the total spending resulting from the first £100 I gave you will reach £1,000. In this case the multiplier is exactly 10.0

What can we use the multiplier for use?

If the government wishes to add £900 million to GDP, perhaps to reduce unemployment, it needs to know how much it should alter, say, income tax, in order to get the desired initial change in consumption. Assume you are an economic advisor to the government – if they ask you “how much should we alter tax?” you could not get away with saying “Quite a lot!”, “More than you might imagine!”, or something similar. The government would want an answer in number form and that is what the multiplier provides.

The interest rate and the level of investment

(Or how government changes the level of investment in order to alter the level of real

GDP).

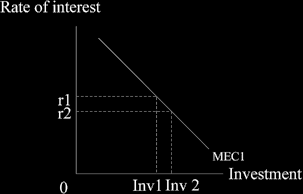

If we lower the rate of interest, the level of investment should increase.

Why? Businesspeople will wish to increase their investment (to make a profit) because they can now borrow more cheaply.

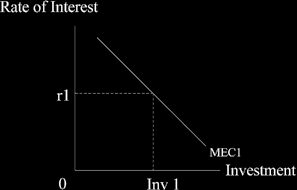

The demand curve for investment (“the marginal efficiency of capital curve”) is ordinarily shaped, downward left to right.

So if we reduce the rate of interest, we can see more investment will be done.

A typical scenario:

a) If the rate of interest is reduced by the Monetary Policy Committee of the Bank of

England, the members hope it will increase the level of investment (the “I” bit of C+I+G)

– and perhaps add to consumption, maybe housing and the purchase of long life goods like `fridges (the “C” part of C+I+G)

b) This in turn pushes up the aggregate demand curve.

c) Which increases the level of GDP; and reduces the rate of unemployment; and probably increases the price level.

A question to think about. When would it not increase prices?

Hint: look at the earlier diagram with three different AD curves on it.